Driving Fraud Prevention, Data Transformation, and Security in FinTech

Client Background

banQi, powered by Airfox is a thriving financial platform with a mission to accelerate financial inclusion in Brazil. Designed for the underserved communities, banQi offers affordable, easy-to-use digital banking solutions complemented by a physical network of branches within Via Varejo’s trusted retail locations.

The Business Challenge

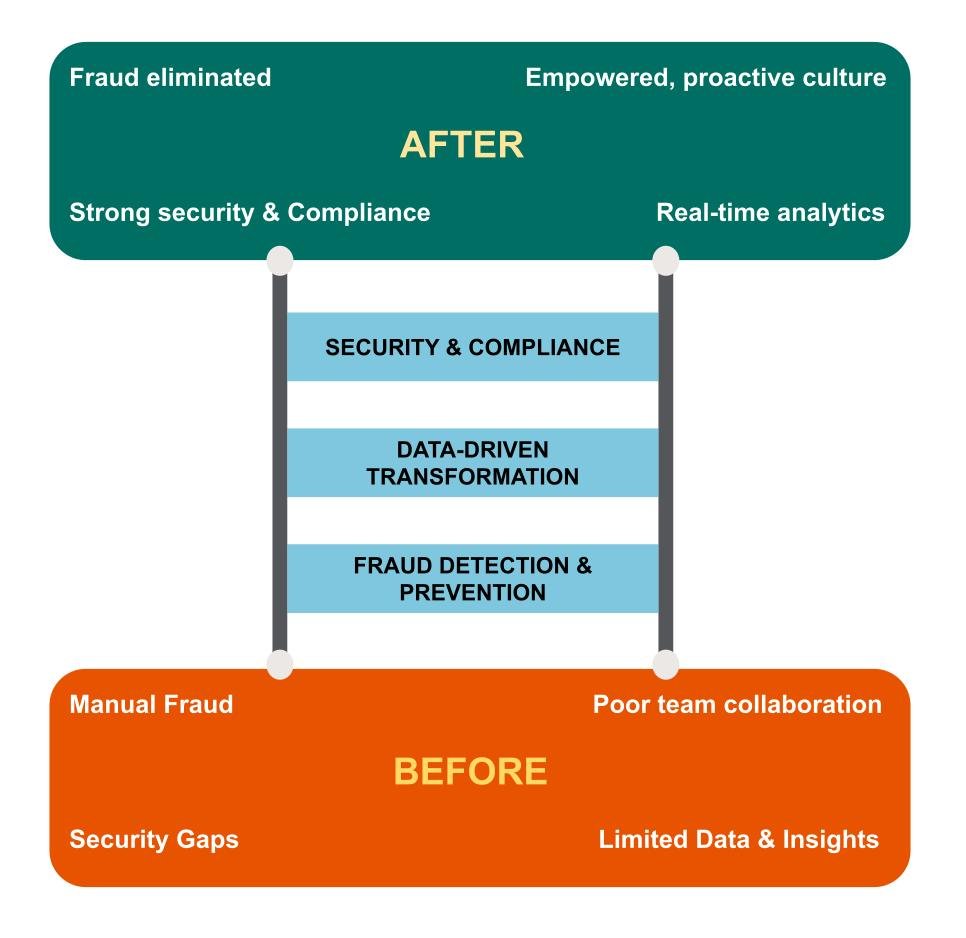

As banQi grew rapidly, several critical challenges surfaced:

Fraud Vulnerabilities: The company faced a surge in fraudulent exploitation of its referral bonus program. A manual review process was resource-intensive and often too late, leading to stolen funds. Existing vendor solutions were ineffective, producing high false negative rates and failing to adapt to banQi’s unique customer profile.

Data Visibility & Scalability Issues: Following initial product launch hurdles, banQi lacked visibility into its data landscape. Without reliable reporting or analytics, identifying and solving operational issues became difficult.

Security & Compliance Risks: With millions of active users, banQi had to ensure proper handling of sensitive data. Noncompliance with regulations could result in fines up to $12 million USD per violation, while poor processes for detecting vulnerabilities or responding to breaches risked both business and customer trust.

The Komodo Solution

Komodo partnered with banQi to design and implement a comprehensive transformation strategy across three fronts:

Fraud Detection and Prevention

Strengthened banQi’s data infrastructure to support advanced data processing and custom capabilities.

Built custom automation, AI algorithms and business logic tailored to banQi’s fraud patterns.

Launched the “Fraud Hub”, a real-time fraud detection system capable of flagging and blocking fraudulent transactions swiftly.

Delivered a real-time fraud dashboard to monitor activity and respond instantly.

Read more at Automatic Fraud Detection with Custom AI

Data-Driven Transformation

Built end-to-end data pipelines and a centralized data warehouse for full visibility across customers, products, and operations.

Implemented real-time operational reporting for Key Performance Indicators (KPIs), empowering all teams with data-driven decision making.

Established and trained a Business Intelligence (BI) team to ensure sustainability of the solutions we built for them.

Developed AI-driven fraud detection models that analyzed customer transaction data, complementing the “Fraud Hub” and additional layers of defense.

Read more at A FinTech Company’s Data-Driven Transformation

Security and Compliance

Designed a 12-month data security plan using updated system documentation, sensitive data mapping, and vulnerability assessments, implementing policies and protocols to ensure compliance and manage risk.

Created company-wide policies governing data handling, user authentication, authorization, and breach response.

Standardized internal operations such as fraud mitigation and incident response.

Trained employees across departments on the data security policies, protocols and processes we developed. This also fostered cross-departmental collaboration between engineering, legal, product, and security teams to ensure holistic protection.

Read more at Digital Security Transformation: From Vulnerable to Secure in 4 Months

The Results

Within months, banQi achieved a dramatic transformation:

Fraud Losses Curtailed: The “Fraud Hub” allowed the company to fight automatic attacks with automatic detection, stopping fraudulent activity in real time. Our solution also eliminated the need to purchase ineffective vendor data.

Data Visibility Unlocked: Operational reporting and BI capabilities gave leadership and teams continuous insight, enabling faster, smarter decisions.

Security Elevated: In just four months, Komodo’s security initiatives set banQi up to pre-empt and respond to threats while ensuring regulatory compliance.

Culture Shift: Employees became active participants in fraud prevention and data security, strengthening trust with millions of users.

Through Komodo’s partnership, banQi successfully evolved into a secure, data-driven, and fraud-resilient fintech platform — reinforcing its mission of financial inclusion with the technological foundation to scale responsibly.

Contact us today to explore how Komodo can empower your organization with the data intelligence it needs to thrive in the digital age.